NDIC, NIESV Deepen Partnership to Enhance Failed Bank Asset Valuation

NDIC, NIESV Deepen Partnership to Enhance Failed Bank Asset Valuation

The Nigeria Deposit Insurance Corporation (NDIC) has called on the Nigerian Institution of Estate Surveyors and Valuers (NIESV) to strengthen strategic collaboration, noting that the Corporation relies heavily on NIESV members for the accurate and credible valuation of failed bank assets, a process critical for effective liquidation and timely payment of depositors.

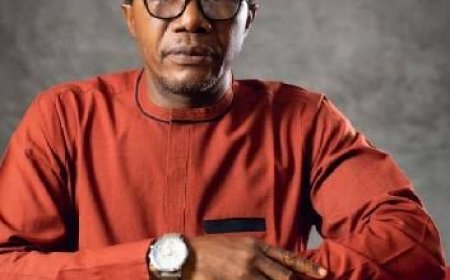

The call was made by the NDIC Managing Director/Chief Executive, Mr. Thompson Oludare Sunday, during a courtesy visit by the President and Chairman of Council of the NIESV, Dr. ESV. Victor Adekunle Alonge, and his executive team to the NDIC Head Office in Abuja.

Mr. Sunday stressed that precise and credible valuation reports are essential during the liquidation of failed banks to determine the true worth of assets, ensuring their sale at the best possible value.

“Proceeds from the sale of these assets are applied toward the payment of depositors’ balances above the insured amount**, making accuracy and professionalism in valuation essential to protecting depositor funds,” the NDIC Chief Executive explained.

He emphasized that NIESV’s professionalism directly contributes to financial stability and depositor protection by ensuring transparency, fairness, and value-for-money in the asset disposal and recovery process.

To support this collaboration, the NDIC is also reinforcing its internal mechanisms, including the development of a comprehensive Asset Management Policy to guide asset identification, documentation, valuation procedures, disposal strategies, and transparency in recoveries.

The MD/CE also specifically called on the NIESV leadership to uphold the highest ethical standards and guard against insider abuse within the profession.

The NDIC Chief Executive also proposed closer ties, welcoming opportunities for joint training and knowledge exchange between NDIC staff and NIESV professionals, particularly in emerging valuation methodologies and sustainable asset management practices.

In response, the President of NIESV, Dr. ESV. Victor Adekunle Alonge, reaffirmed the Institution’s commitment to professionalism and integrity. He noted that NIESV maintains strict disciplinary procedures to sanction any member found to be unethical or unprofessional, stating:

“The partnership remains vital to enhancing service delivery and strengthening public confidence in the banking system.”

The courtesy visit underscored the shared commitment of both institutions to deepen collaboration and enhance professional standards for the overall stability of the Nigerian financial system.

What's Your Reaction?

The Chairman and Chief Executive Officer of Adron Homes and Properties Limited, Aare Adetola Emmanuelking, has congratulated the Government and people of Oyo State as the state marks its 50th anniversary, describing the occasion as a celebration of resilience, cultural pride, and sustained progress.

The Chairman and Chief Executive Officer of Adron Homes and Properties Limited, Aare Adetola Emmanuelking, has congratulated the Government and people of Oyo State as the state marks its 50th anniversary, describing the occasion as a celebration of resilience, cultural pride, and sustained progress.